Indian customers at the moment are extra involved about their well being than ever, and entrepreneurs on the market try all they will to faucet into this market to satiate their prospects’ craving by giving a wholesome twist to what they devour.

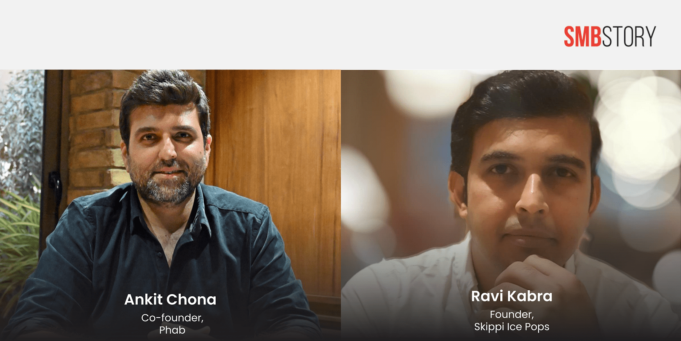

This week, SMBStory got here throughout Skippi Ice Pops and Phab, who’re offering wholesome variants to prospects and rising considerably.

Skippi Ice Pops

Indians are identified for having a candy tooth and whereas ice pops are probably the most well-liked desserts within the Indian subcontinent, with the ice cream market within the nation reaching over Rs 14,000 crore in 2020, the trade is basically unorganised and hardly has any formal gamers, says Ravi Kabra, Founding father of ice pops model Skippi Ice Pops.

Skippi (often known as Kabra World) is an offshoot of Prabhat Udyog, a bigger FMCG firm began by Ravi’s father, Pravin Kabra, in 1980.

Ravi realised the existence of this formal hole when he was residing in Australia (between 2018-19) and his sister came over him.

“We loved ice pops rather a lot in Sydney. So when my sister got here from India to go to, she needed to pack some and take them again together with her,” he narrates, including, “This grew to become a turning level for us.”

Ravi and his spouse Anuja Kabra began researching the market. After chatting with mates in several cities, the duo realised that the hole actually existed.

“Initially, I used to be shocked as a result of India is far hotter and extra humid than Australia, and but, doesn’t have any formal gamers.”

In 2019, Ravi and Anuja, (whereas nonetheless in Australia), began their analysis and arrange a unit in Hyderabad.

“As we speak’s customers have grow to be very health-conscious. They need to learn the label and know every thing.” Ravi mentioned, including flavours for Skippi Ice Pops are extracted from pure fruit and veggies.

They returned to India and had been able to launch the product in March 2020, when the nationwide lockdown was introduced in the midst of the month, bringing every thing to a grinding halt.

“It was an enormous loss for us as leases, salaries, and different bills needed to be taken care of,” Ravi recollects.

The enterprise couldn’t function for a yr – from March 2020 to March 2021. When restrictions had been lifted, Skippi made an entry into the market to a heat response.

“Our gross sales had been booming as a result of we realised that in the summertime months, individuals who had been principally sitting at residence needed to devour ice pops,” he provides.

Since inception, Skippi has clocked revenues value Rs 60 lakh.

Phab

From 2005 to 2018, Ankit Chona was the Managing Director of ice cream chain Havmor Ice Cream Restricted (HIL). When the enterprise was offered off to South Korean main Lotte Confectionary three years in the past, Ankit determined to search for the following alternative.

“Being within the ice-cream trade, now we have grown up consuming lots of sugar. So, the pure thought course of was to do one thing within the meals trade solely, however hold the product wholesome,” Ankit tells SMBStory, including that he was additionally eager to discover one thing that was “futuristic”.

Consequently, he noticed an immense market alternative within the well being and wellness house. That’s how the concept of beginning Phab, a wholesome snack model, germinated.

Phab, which has 15 SKUs, began out in February 2020 by launching protein powders and steadily shifted to different gadgets reminiscent of snack bars, protein shakes, and protein bombs. The model claims that the merchandise don’t include any preservatives, sugar, or synthetic sweeteners.

Different prime picks of the week:

CredAble

Although MSMEs form the backbone of the country and have been fuelling the expansion of huge enterprises by usually being their major sources of uncooked materials, the sector is going through an acute monetary disaster, together with the dearth of working capital.

For any enterprise to be viable, a gentle circulate of capital is important to make routine funds, cowl sudden prices, buy primary supplies, manufacturing of products, and so forth. Nevertheless, most MSMEs that function their enterprise historically discover it troublesome to pivot in accordance with the altering ecosystem and face a problem in relation to development.

Within the final two years, many startups have come ahead to assist MSMEs and provides their monetary well being a lift by introducing numerous campaigns and initiatives.

CredAble, a Mumbai-based fintech startup based in 2017, is enabling working capital financing by offering liquidity programmes for enterprise ecosystems utilizing know-how platforms, digital KYC and onboarding, deep ERP, financial institution integrations, digital documentation, and transaction administration.

Preserving the monetary and operational wants of MSMEs in thoughts, the startup just lately launched UpScale, an answer that connects with the enterprise’ current accounting software program, syncs transaction particulars, connects with financial institution accounts and credit score bureaus, and provides instantaneous entry to working capital with the assistance of partnered monetary establishments.